CariCRIS Rating Process

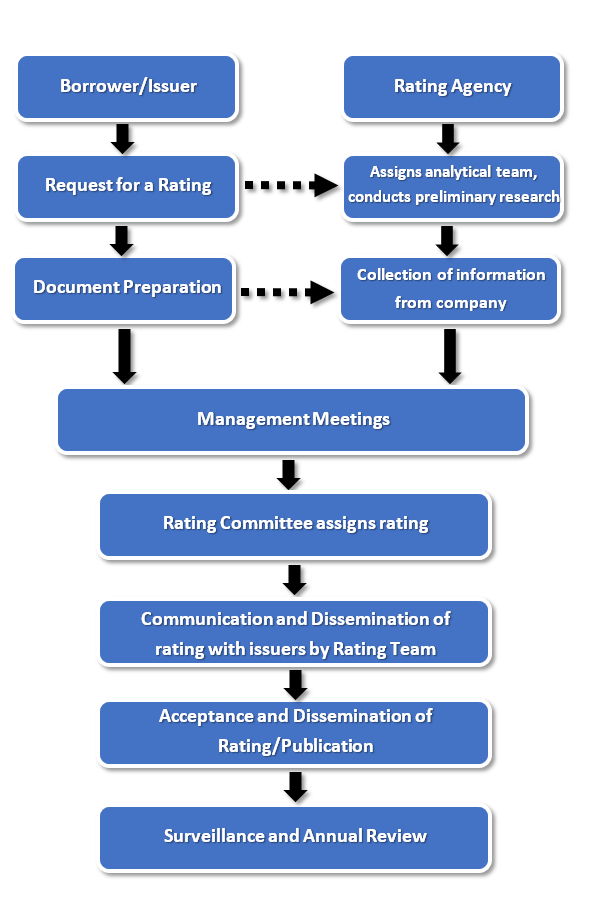

CariCRIS' Rating Process begins with a specific rating mandate from the issuer as CariCRIS has a policy of not assigning any unsolicited ratings. Once CariCRIS receives its mandate, together with applicable fees, CariCRIS deputes a team of analysts, designated as the 'rating team', to take the rating assignment forward. As a policy, all rating assignments are executed by a team of two or more analysts, to eliminate any bias in sourcing / analysing information.

The rating team conducts preliminary research and collect relevant information from the issuer, prior to conducting management meetings with various business heads and top management of the issuer. The analysis is then presented to CariCRIS' independent Rating Committee, which has the sole authority to assign credit ratings.

The ratings thus assigned by the Rating Committee are communicated orally to the management, along with key drivers for the rating. At this juncture, the management has the choice of either accepting the rating or not accepting the rating. If the management chooses not to accept the rating, CariCRIS does not disclose such ratings to any third party, as per its policy on disclosure of unaccepted ratings.

If the management accepts the rating, by signing a rating acceptance letter, CariCRIS disseminates such ratings by issuing a media release. The media release / rating rationale will also be available on the CariCRIS website. The accepted ratings can be withdrawn only after the rated instrument is fully redeemed / extinguished, as per CariCRIS' stated policy on rating withdrawals.

All accepted ratings are kept under continuous surveillance throughout the life of the instrument, as per CariCRIS' policy on review of ratings and any revision in such ratings (such as upgrade / downgrade / rating placed on rating watch, etc.) are swiftly disseminated through a media release, for the benefit of the investors.

A schematic of the rating process is given below:

Limitations of the Ratings Process

- Ratings assigned by CariCRIS reflect CariCRIS’ current opinion on the relative creditworthiness of the rated entity (issuer rating) or an instrument issued by the entity (issue rating) and does not constitute an audit of the company by CariCRIS.

- A CariCRIS rating is not a recommendation to buy, sell or hold the rated instrument or shares of the rated entity.

- CariCRIS’ ratings are based on the current information provided to CariCRIS by the rated entity or obtained by CariCRIS from sources it considers reliable. CariCRIS does not guarantee the completeness or accuracy of the information on which the rating is based.

- CariCRIS relies on good faith on the information, whether written, oral, digital or in any other form, provided by the rated entity and/or authorised for provision to CariCRIS by a third party for the purpose of the rating assignment.

Ratings Review Process

CariCRIS reviews all outstanding ratings on an ongoing basis. Our reviews consist of:

- A daily review of developments pertaining to the company/sovereign, e.g. in the case of companies corporate actions such as mergers, acquisitions, de-mergers, ownership change, change in parent rating, etc to satisfy ourselves that the outstanding ratings are appropriate and if not to initiate the process for a rating action.

- For ratings identified as vulnerable, a monthly telephone conversation with the issuer to keep abreast of developments and the direction of performance.

- A quarterly teleconference with the issuer to discuss detailed quarterly financial performance and other key developments.

- Meeting with senior management at least once a year to understand strategic plans and new initiatives, as well as any impact of company or industry developments.

Ratings Appeal Process

- A written appeal request must be submitted by the client referring to the rating rationale submitted by CariCRIS and detailing the reasons for and factors supporting the request for an appeal of the ratings.

- The rating team will then analyse each point raised by the client and express their opinion on each of the points in an appeal note to be submitted to the rating committee.

- All appeal requests must be discussed at the rating committee within sixty working days from the date of the written appeal request from the client.